Physical Address

#1 Shell Camp Owerri, Nigeria

Over the past years, investing has become a viable alternative for people to gain additional income and grow their wealth in the long term.

Even international students studying in the US seek to expand their financial portfolio by trading in the world’s largest stock market.

Thanks to digital technology and internet connectivity, trading and investing online have become more accessible and doable for more people, regardless of trading experience.

Among the many trading and investment platforms available today, MetaTrader 5 stands out for its myriad functionalities and features, allowing traders worldwide to access investment and brokerage services.

Below, we’ll look at what beginner traders can learn about investing from MetaTrader 5:

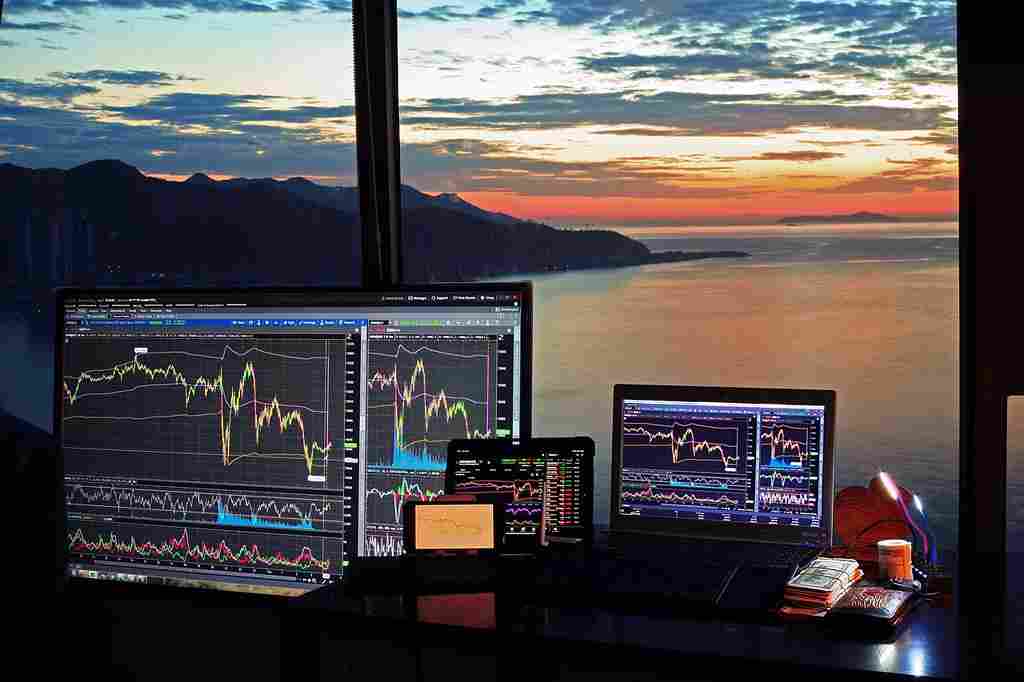

One of the main features of MetaTrader 5 is the availability of charts and timeframes that users can use to visually monitor real-time price movements in charts of one-minute to one-month intervals and up to 21 timeframes simultaneously.

The platform also broadcasts the latest financial news reports for traders to keep up-to-date on relevant markets, allowing them to be better prepared for price fluctuations and other market events.

By observing the real-time changes in data, traders can learn how market prices fluctuate throughout the day or different periods and react accordingly to economic events, news releases, and other factors.

MetaTrader 5 also provides accurate historical data, helping traders backtest trading strategies.

This is done by assessing the performance of different trading strategies over time and making appropriate adjustments for better results in the future.

Nowadays, people also rely on other AI-powered tools to help with backtesting.

For example, some traders have tested the effectiveness of AI chatbot ChatGPT in facilitating backtesting and simulation.

The AI-powered language model can simulate historical market scenarios and apply your planned trading strategies.

It will then assess the performance and reveal potential risks with different approaches, allowing you to refine your trading strategies.

MetaTrader 5 also offers a demo trading feature that allows traders to “practice” trading with virtual money.

This feature has been available since the platform’s predecessor — MT4 — enabling users to open a demo account.

Users can practice trading strategies using a demo account without risking real money or assets.

Demo trading also lets users get used to the platform’s features, which can be great for beginners or people new to the MetaTrader platform.

In the long term, traders can gain confidence by developing a strategy that suits their needs and risk appetite.

Finally, if you want to take your trading experience to the next level, MetaTrader 5 also supports algorithmic or automated trading.

On the platform, trading robots are called Expert Advisors and can teach you about programming and how these algorithms can be used in investing.

Users can also develop their trading robots or technical indicators using the platform’s specialized MetaEditor tool, which operates based on the programming language MetaQuotes Language 5 (MQL5).

Moreover, algo trading has become popular in recent years as it allows traders to place trades based on a predetermined set of instructions — an algorithm.

This way, profits may be generated at a pace and frequency that brings in more profits for traders without needing to be active 24/7.

This follows a trend noted by Forbes Africa, which suggests artificial intelligence and algorithms are poised to disrupt the finance sector and automate much of its activity.

Ultimately, it’s important to remember that while trading and investing can be a great way to grow your income and gain financial literacy, risks are always involved.

While trading platforms like MetaTrader 5 offer many features that can assist you in the process or make trading easier to understand, you should still always do your due diligence by keeping up with relevant market and geopolitical news that may affect your investment portfolios.

Awesome one; I hope this article answers your question.

Editor’s Recommendations:

If you find this article good, please share it with a friend.